Industry Issues and Trends

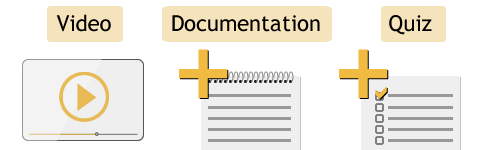

Through a combination of videos, course notes and a quiz, you will be guided through everything you are expected to know under the "Industry Issues and Trends" section of the FIA Syllabus.

THE MODULE CONSISTS OF:

- Video: 42 minutes of information.

- Course notes: 14 pages of downloadable summary notes. The notes are clearly marked and follow each of the topics listed on the FIA syllabus. The notes should be worked through in conjunction with the videos to ensure you are fully prepared to take the exam. We recommend you print these off and make notes as you watch the videos.

- Quiz to test your knowledge: Complete the quiz after you have finished studying the videos and course notes. It is recommended that you do the quiz without referring to the notes so that you gain a better understanding of the areas you may need to focus on. You will be provided with your score at the end.

HOW LONG DO I HAVE ACCESS FOR?

You have access to the course for 365 days from the date of purchase.

HAPPY LEARNING!

TO BOOK YOUR EXAM PLEASE DO SO VIA THE FISD WEBSITE

Click here

FISD FIA 2016 SYLLABUS v4.0

INDUSTRY ISSUES & TRENDS - MODULE 4

This part of the syllabus will be the most fluid and hence may be updated on a more regular basis. A candidate should demonstrate that he or she has a robust grasp of some of the key issues and associated trends that are influencing the development and evolution of the market and reference data industry.

4.1 MARKET REGULATION AND MARKET STRUCTURE

A candidate should demonstrate a broad understanding of how market structures are changing and why. They should have a robust high level appreciation of key government regulations and their impact on the market and reference data industry.

4.1.1 The US Markets

A candidate should have a broad understanding of how the U.S. Securities and Exchange Commission (SEC) regulates the U.S. equities markets and how the Commodity Futures Trading Commission (CFTC) regulates the futures markets - with special attention to how this impacts market data. They should understand the key elements of the recent regulations with particular focus on how this affects market data, and they should understand how the U.S. regulations and markets have changed in recent years, including:

• The Dodd Frank Act – including the Office of Financial Research

• FATCA – The Foreign Account Tax Compliance Act

• SEC interest in the US consolidated tape and exchange data more generally

4.1.2 The EU markets

A candidate should understand the recent changes in EU regulation; they should understand the changing face of the European Equities Markets including:

• The roles, interactions and areas of responsibility of supra-national regulators (ESMA) and national regulators (FCA, AMF, BaFIN, etc.)

• The concept of a European Consolidated Tape

• Regulation on privacy notably GDPR

4.1.3 Global

A candidate should understand at a high level some of the broader global regulation of the financial markets, taking special note of how this might affect market and reference data. Including:

• FRTB - The fundamental review of the trading book

4.2 COMMERCIAL, CONTRACTUAL, ECONOMIC AND POLITICAL

A candidate should be able to demonstrate a broad understanding of some of the key and recent debates surrounding market and reference data, including:

• The contentious issue of data “audits”

• The development of non-display application use of market data

• The rise of alternative data

• The growing use of the cloud

• The role of AI and machine learning

• The part blockchain plays in the industry

• BigTech (eg Amazon's AWS, Google and Microsoft)

• The ethics discussion as it relates to data

• The changing business model of exchanges as they broaden into other information services

A candidate should be able to demonstrate a broad grasp of some of the macroeconomic factors affecting our industry, including:

• The demise of LIBOR and its proposed replacements

• The growing interest in ESG and the challenges in respect to data

• High frequency trading and fast markets - why do politicians care

• China - stock connect and other issues

• Cross continent collaborations between exchanges

• Brexit - from both the 'in' and 'out' perspectives

• The shift from active to passive investing

• The increased focus on privacy

• The increasing interest in and concern about crypto currencies